It simplifies bookkeeping management can generate more timely variance reports it allows materials to be carried in the inventory accounts at standard cost. Most companies compute the materials price variance when materials are placed into production.

Compute And Evaluate Materials Variances Principles Of Accounting Volume 2 Managerial Accounting

Actual price per pound.

. An adverse material price variance indicates higher purchase costs incurred during the period compared with the standard. The standard material inputs per batch are. DMPV Actual Quantity Standard Price Actual Price DMPV 20000 100 80 DMPV 20000 20.

Most companies compute the material price variance when materials are ______ and the material quantity variance when materials are ______. Factoring out actual quantity used from both components of the formula it can be rewritten as. Calculate the material price variance and the material quantity variance.

Number of units spoiled. Most companies compute the materials price variance when materials are purchased. Quantity of direct materials spoiled.

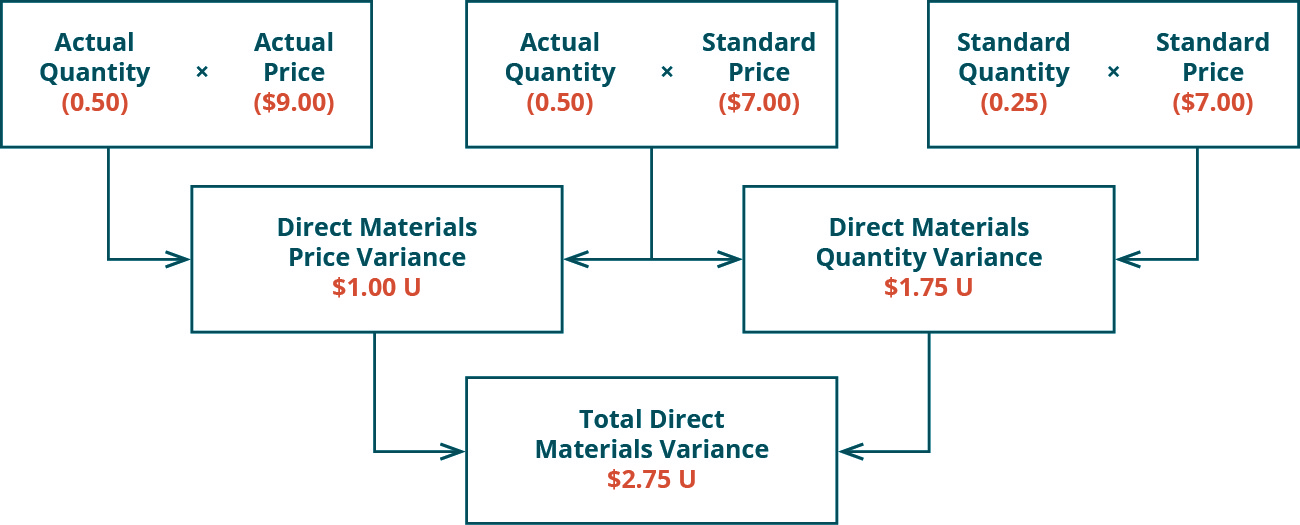

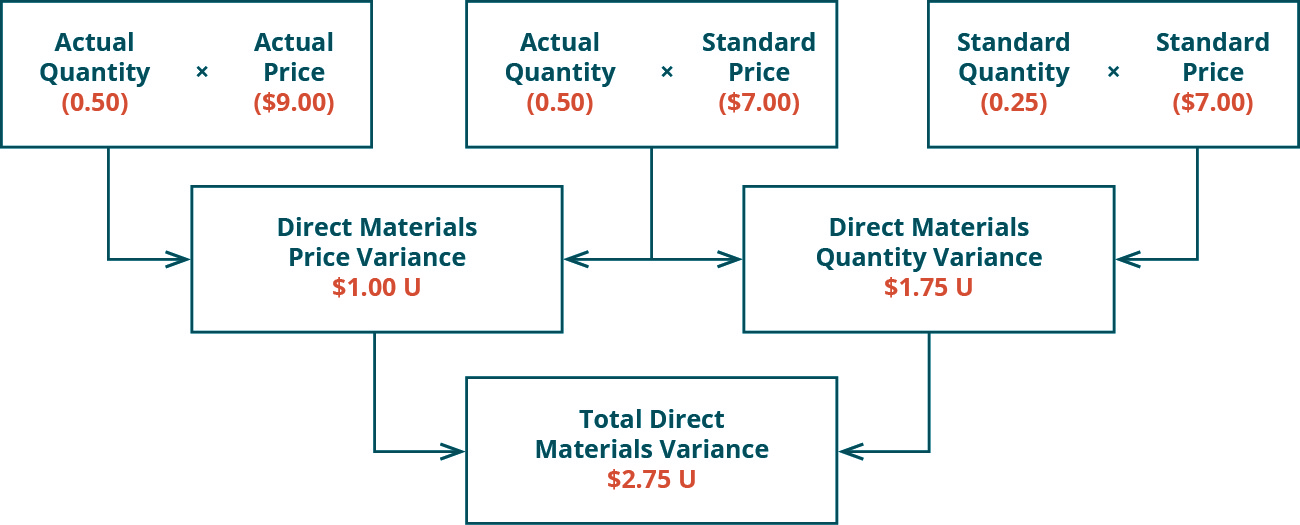

A Materials price variance AQ AP AQ SP b Materials quantity variance SPAQ SQ 13901300 990 4309 U SQ Standard quantity per unit Actual output 45 220 990. The formula of this variance is. Order a print copy.

Actual quantity of input at actual price 15625 2 31250. Number of units purchasedB. Standard quantity of material for actual test 9003300 3 12600 plates Actual quantity of material purchased 16500 plates Actual quantity of material used 16500 - 2300 14200 plates Standard price of material 225 Actual pr.

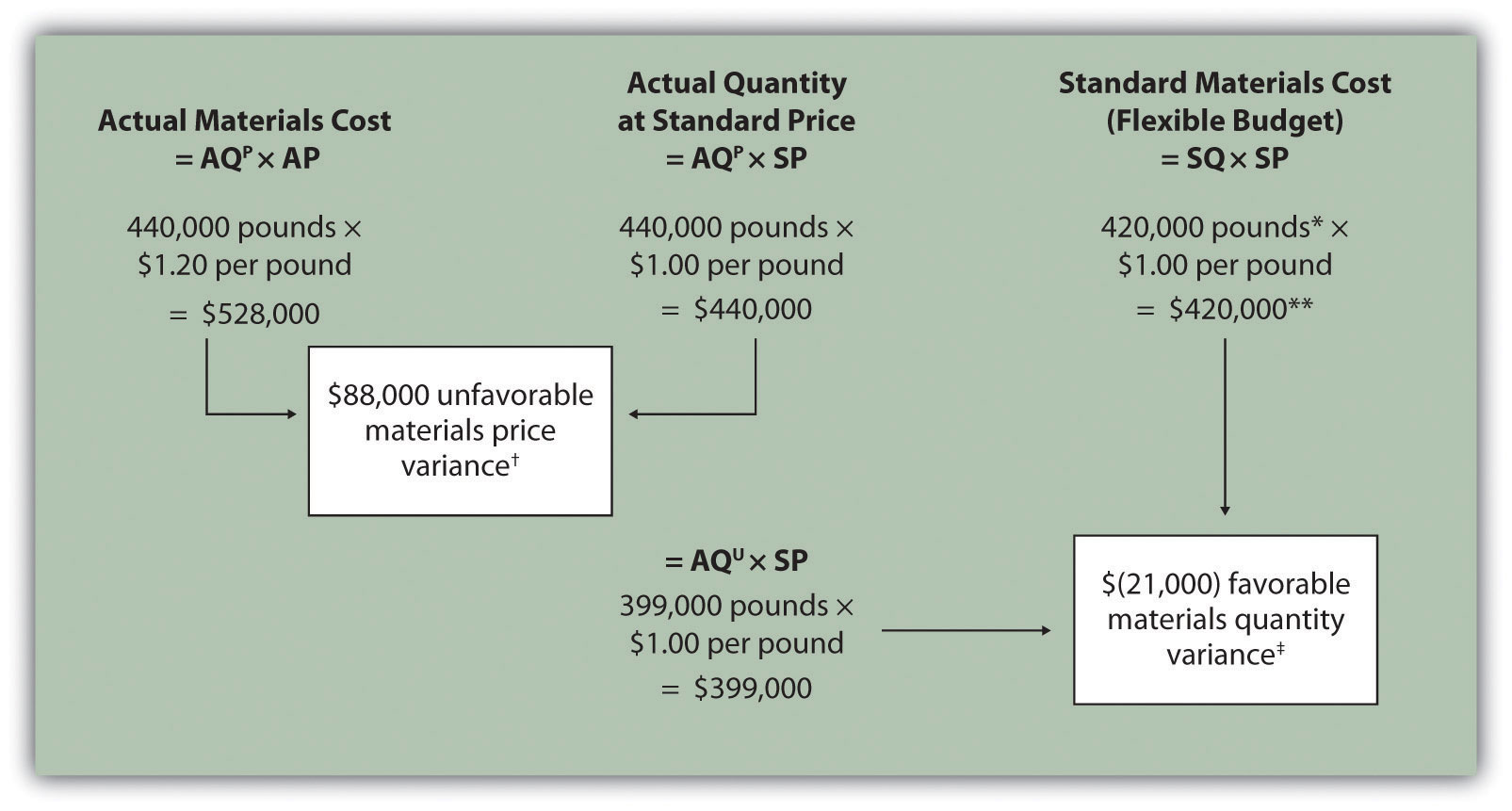

The materials price variance is generally calculated at the time materials are purchased because. The direct materials price variance compares the actual price per unit pound or yard for example of the direct materials to the standard price per unit of direct materials. Waste scrap production issues or improper training.

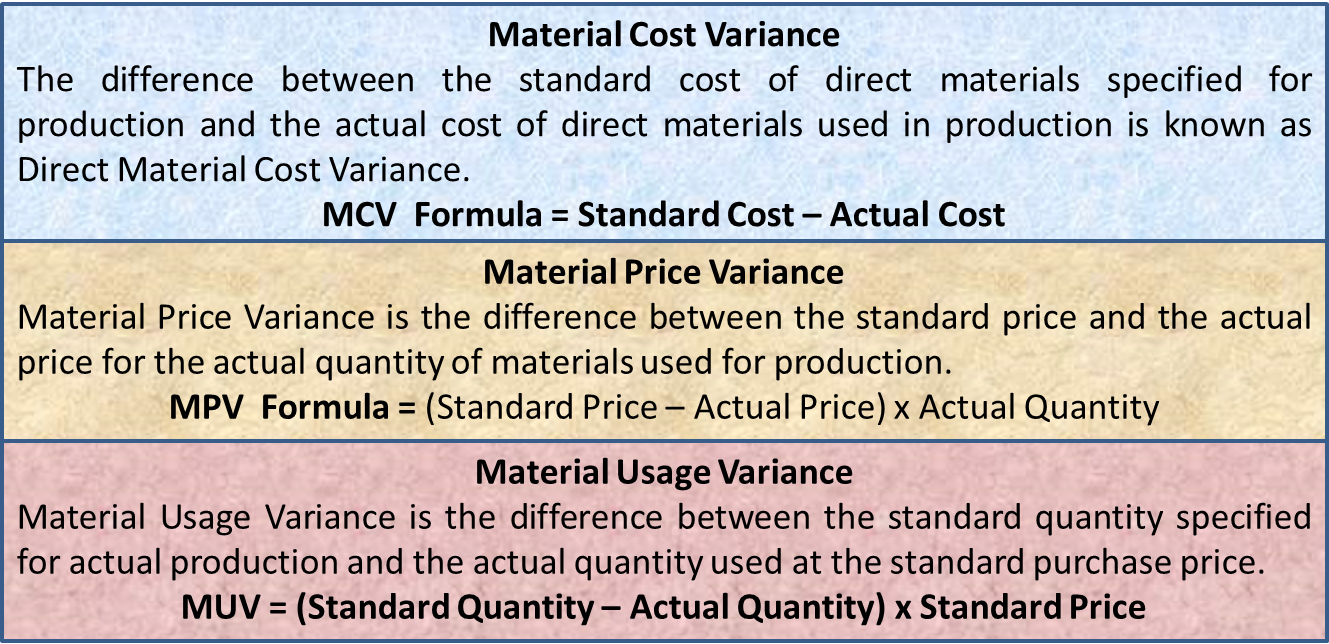

This is concerned solely with the price at which direct materials were acquired. The materials price variance is the difference between the actual and budgeted cost to acquire materials multiplied by the total number of units purchased. Let us understand this formula with the help of an example.

Most companies compute the material price variance when materials are _____ and the material quantity variance when materials are _____. To calculate material price variance subtract the actual price per unit of material from the budgeted price per unit of material and multiply by the actual quantity of direct material used. The Material Price Variance will be favorable if the actual price paid for the materials is less than the standard price.

The standard material cost of each box is therefore 361. We can also calculate the price variance using the second formula. Increase in bargaining power of.

The formula for direct materials price variance is calculated as. An overall hike in the market price of materials. The variance is used to spot instances in which a business may be overpaying for raw materials and components.

Actual price - Standard price x Actual quantity. Material Price Variance Formula. Managers should not use standards to assign blame.

Quantity of direct materials that should have been used in. Purchase price variance. A What is the materials price variance for the month.

Youre most likely to run into an unfavorable materials quantity variance because of one of the following issues. Quantity pounds Price per pound Standard Cost of Material Material A 420 006 2520 Material B 70 012 840 Material C 10 025 250 Total batch 500 3610 The finished product is packed in 50-pound boxes. Group of choices A.

Quantity of direct materials purchased. A materials price variance is favorable if the actual price exceeds the standard price. In contrast if the price paid for the materials is greater than the standard price the Material.

So our spending variance is 10250. Direct materials price variance Actual quantity purchased Actual rate Actual quantity purchased Standard rate 8500 7500 1000 Unfavorable. Number of units that should have been used.

This is concerned solely with the number of units of the materials used in the production process. This is because Most companies compute the materials price variance when materials. The material price variance in this example is favorable because the company was able to get the materials at a lower cost compared to the budget.

Purchase of materials of higher quality than the standard this will be reflected in favorable material usage variance. Most companies base the calculation of the materials price variance on the. Multiple choice - 27381275.

Reasons for adverse material price variance include. Number of units to be purchased during the next accounting period. Most companies base the calculation of the material price variance on the.

See the answer See the answer done loading. For example say that a dress company used 1000 yards of fabric during the month. Aptex has an unfavorable materials price variance for June because the actual price paid 8500 is more than the standard price allowed 7500 for 5000 meters of copper coil.

MPV Standard Price Actual Price x Actual Quantity. A company can compute these materials variances and from these calculations can interpret the results and decide how to address these differences. A Material Price Variance MPV occurs when the actual price paid for materials used in production is different than the standard price for the materials.

Because it is required component for the computation of materials quantity variance. We now have spent 31250 on our raw materials when we had budgeted 21000. Actual quantity used x Standard price Standard quantity allowed x Standard price The standard quantity allowed for producing 3000 boxes is not available in the original problem so we have to compute it as follows.

B What is the materials quantity variance for the month. View the full answer. Actual unit usage - Standard unit usage x Standard.

The calculation of Material Price Variance using the following formula is as follows. Number of units actually used. Actual price - Standard price x Actual quantity used Material price variance.

Variance Analysis 1 Lecture Ppt Video Online Download

Direct Materials Variance Analysis Accounting For Managers

Material Variance Cost Price Usage Variance Formula Example Efm

0 Comments